10 factors that affect your trucking insurance premiums

Every decision a business owner makes has an impact on their business. And each decision moves that business forward or backward. Which means each decision has an element of importance associated with it. So we want to share with you certain decisions that affect how your insurance policy rates are built.

Most insurance companies have different equations on building rates for trucking companies. However, there are some generalizations that can be made regarding their rating process that impact you as the business owner. The purpose of our Agency 801 Trucking Calculator is to provide you with a general understanding of how your rates are affected by certain factors. (The calculator is for information purposes only and does not guarantee in any way what your insurance premiums will be.) Here we explain in more detail those factors that affect your insurance the most.

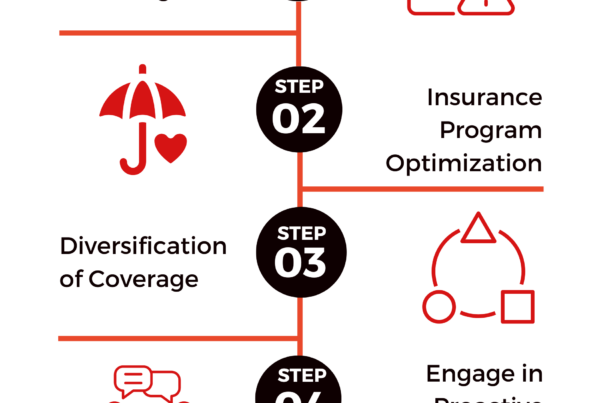

Top 10 factors that influence your insurance:

1. Garaging Location – Where you are located lays the groundwork for your insurance. It is the starting point of how much insurance you are going to pay. Garaging locations in heavily congested areas will have a higher base rate than those in more rural locations.

2. Years in Business – How long you’ve been in business matters. Sometimes this can be influenced by experience, but 3 years of existence is the magic number for starting to influence your rates positively, and your insurance options begin to expand.

3. Cargo – What kind of product do you haul? Each commodity has different risks and values. Whether you haul paper products, hazardous materials, or autos, those products will influence how much your insurance will cost.

4. Driver Quality – This factor has a major influence on your rates. Drivers with more experience, minimal driving violations, and no accidents will IMPROVE your rates. However, if you hire inexperienced drivers or drivers with poor records, who have had accidents, or tickets and violations, you will see a significant INCREASE in insurance rates. (Be sure to check out ‘Managing Your Drivers’ for more information.)

5. Maintenance and Out of Service – Maintaining your vehicles improves the vehicles response time in avoiding accidents, reduces downtime for inspections, and helps prevent DOT violations. If you have higher than average Out of Service rates, you will see higher insurance rates, whereas implementing a truck maintenance program will potentially improve your trucking insurance rates. (Check out the article ‘Doing the little things’ for more details on Maintenance and Inspections.)

6. Formal Safety Programs – Do you hold safety meetings with your drivers? Do you require pre and post trip inspections? Do you provide ongoing training? This simple practice can improve your insurance rates in many ways, and is highly recommended.

7. Claims History – You probably already knew this, but at fault accidents will increase your rates. But, did you know that small claims, such as replacing a windshield, can also increase your rates noticeably? High deductibles can help discourage you from making smaller claims. Just think of a claim as basically a LOAN from the insurance company that you will have to pay back. Claims will almost always raise your rates.

8. Radius of Operations – How far do you travel on average? This has an impact on your insurance premiums. Rates go up the further you drive away from your garaging location.

9. Financials – Are you making money? Good rule of thumb – if your current ratio (Current Assets divided by Current Liabilities) is greater than 1.00, then you are more likely to be able to pay your bills, handle unforeseen expenses, and stay on top of maintenance. Insurance companies are like a business partner, and they want to go into business with trucking companies that are running a profitable and safe operation, with a low risk profile. Then it’s a win win for both parties.

10. Your Insurance Agent – Do they understand your industry? Or your business itself? Navigating insurance can be tricky, and your agent can help save you money, or cost you money. Your agent is your business advisor, and should know who you are and what you do. Not getting good advice from your agent? Then maybe it’s time to find a new agent.

We believe that an informed buyer is the best customer to have. We like to give you as much information as possible. We want your business to succeed. And when you’re empowered with information to control your insurance rates, you will have a greater ability to succeed. And that is our goal for your business.